Bank of Maldives makes super-normal profits in 2021

The Bank of Maldives posted a significant profit in 2021 at MVR1.7 billion, compared to MVR324 million in 2020.

Source - BML Website

The Bank of Maldives posted a significant profit in 2021 at MVR1.7 billion, compared to MVR324 million in 2020.

Source - BML Website

The Bank of Maldives (BML) posted a Profit After Tax of MVR354 million for the final quarter of 2021, yielding the bank a full-year Profit After Tax of MVR1.7 billion [unaudited]. This is a significant increase compared to the profit posted in 2020, at MVR325 million.

The BML has said that its performance, in addition to the recovery of a NPL, is based on a strong post-COVID recovery with "better than anticipated performance from all business lines." Its assets grew by MVR7.6 billion and customer deposits by MVR5.3 billion, while its lending grew with "MVR3.3 billion in new loans to businesses and individuals" during the year.

The bank recorded over MVR3.8 billion as total income in 2021, compared to MVR 2.7 billion in 2020. Looking at the breakdown of income, total interest income amounted to MVR 2.1 billion, while income from fees and commissions amounted to MVR1.13 billion. The bank has spent MVR308 million on personnel expenses, while MVR252 million was spent on other operational and administrative expenses. The bank also spent almost MVR1.6 million per month on marketing and CSR activities, registering an annual total of MVR18.8 million in 2021.

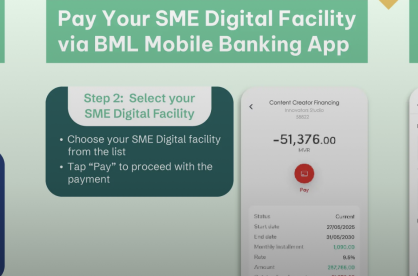

The BML has been criticized by its customers and the public for its high interest rates, especially, with personal loans costing 15 percent per annum. As per the published schedule of charges of the bank, the base rate of lending for MVR loans is at 10 percent. The SME and business loans carry 12-13 percent interest rate per annum. It has also announced a reduction in the interest rates for Home Loans and Financing to 9 percent, from the earlier 12 percent.

The BML is the only bank in the Maldives with a wide network of branches and ATMs in the atolls. With over 295,000 customers, the bank enjoys the highest market share in the SME, corporate, and retail segments.

As commercial banks are required to pay 25 percent profit tax to the government, the total expected tax income from last year’s profits, to the government from BML is at MVR646 million. Additionally, provided that majority of the shares of the bank is held directly by the government, the government is also likely to receive MVR 300-500 million as dividends.

The Bank was established in 1982, and in November this year, the bank celebrates its 40th anniversary, and as such, the bank has announced series of monthly initiatives to support and appreciate its customers, communicates, and colleagues.

Some of the notable new initiatives of the Bank during the fourth quarter include the launching it its new US Dollar Visa Credit Card, without any of the existing foreign transaction limits. It also increased the limit on foreign card transactions to USD750. It launched a new rewards program, BML Rewards, a loyalty program for credit card holders.

The Bank has also made great strides with its recognition of employees, through its existing Staff Awards, Long Service Awards and a new program to "promote positive mental well-being in the workplace." These initiatives stand testament to the Bank receiving 'Asia's Best Employer Brand Award' for the fourth time.

The BML is a majority government-owned company, with the Government of Maldives directly holding 50.80 percent of shares, 7.33 percent through the Government Employees Provident Fund. Majority government-owned Maldives Transport and Contracting Company (PLC) holds 5.07 percent of shared, atoll and island community accounts hold 4.07 percent, and the general public holds 33.73 percent of shares. There was no change in shareholding structure during the year.

While the government controls a majority in the bank’s ownership, eight out of the 11 directors in the board are nominated by the government. This means that the government has the discretion to, in the interest of the public, make business decisions, especially on the interest rates and other charges of the bank, through its board members.