The banking sector profits increase in 2021

Source: Bank of Maldives Plc

Source: Bank of Maldives Plc

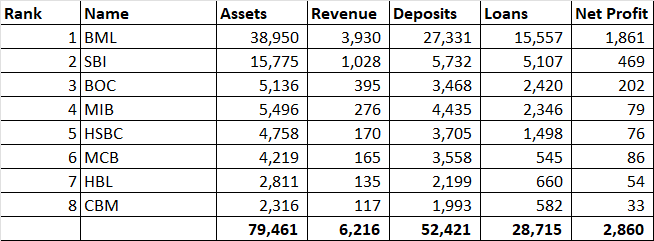

Bank of Maldives (BML) continues to dominate the banking industry with over 50 percent market share in terms of all major indicators. The banking industry recorded a total MVR 6.2 billion in revenue in 2021, with 63 percent share of BML with MVR 3.9 billion. The second in the rank, State Bank of India (SBI) recorded MVR 1.03 billion last year, corresponding to 17 percent market share. The third in the rank, Bank of Ceylon (BOC) had only MVR 395 million as revenue, which is just 6 percent of the market.

With BML achieving a record profit of over MVR 1.8 billion in 2021, the banking industry enjoyed a 206 percent growth in net profits compared to 2020. Other higher achievers in 2021 in relation to 2020 on the profits front are Habib Bank Limited (HBL), and Mauritius Commercial Bank (MCB), with HBL increasing profits by 100 percent while MCB achieving a rise in profits by 200 percent.

Despite the significant growth in the profitability, total loans grew by only 9 percent in 2021. SBI recorded a negative growth in loans last year. HBL and HSBC recorded significant growth in loans, with 99 percent and 137 percent growth respectively.

Total deposits in the banking sector grew by 27 percent in 2021, reaching MVR 52.4 billion. Out of this BML has a 52 percent share with MVR 27.3 billion in deposits, while SBI has 11 percent share with MVR 5.7 billion.

The percentage of Non-performing loans (NPL) slightly decreased in 2021 to 7 percent from 8 percent in 2020.

The Maldives banking sector consists of three local banks; the Bank of Maldives Plc, Maldives Islamic Bank Plc (MIB), and the Commercial Bank of Maldives (CBM). The rest of the five banks are branches of foreign banks. There is government ownership in both BML and MIB, which are also public listed companies.

As at end 2021, the country has 60 bank branches in total, out of which 37 are in the outer atolls. Total number of ATMs stands at 163, out of which 82 are in the atolls.